2024 is a crucial year for the progress and challenges of the North American cannabis industry, laying the foundation for the transformation in 2025.

After a fierce presidential election campaign, with the continuous adjustments and changes of the new government, the prospects for the coming year are still full of uncertainty.

Despite the relatively flat state centered positive reforms in 2024, with Ohio becoming the only new state to legalize recreational marijuana, the milestone federal marijuana reform may be pushed forward next year.

Next year, in addition to the highly anticipated reclassification of marijuana and the banking bill ‘SAFER’, 2025 will also be the most crucial year for the cannabis industry, as the Agricultural Act 2025 is about to be enacted.

In Canada, the government is proposing to modify the cannabis consumption tax, which may ultimately result in some tax reductions by 2025.

Although industry leaders are optimistic about the next 12 months, the industry is also facing enormous pressure, including price compression, operational transformation, and fragmented regulatory frameworks.

What is the outlook for the cannabis industry in 2025? Let’s hear what industry insiders have to say.

Joint CEO and co-founder David Kooi

“I doubt whether the federal legalization and legislation can be realistic after the election. Our government has not listened to the people’s opinions for many years. More than 70% of Americans support the legalization of marijuana, and the public support rate has exceeded 50% for more than 10 years, but the federal action is zero. Why? Special interests, cultural wars and political games. No party has won 60 votes to make changes. Congress would rather prevent the other party from winning than do what the people really want.”

Vince C Ning, CEO and co-founder of Nabis Corporation

After the 2024 election, the national marijuana industry needs to put its expectations into practice – the path of bipartisan cooperation is crucial for meaningful reform, but with the new government in power, the situation is still unclear. Although we have seen the momentum of federal marijuana legalization increasing over the past year, it is unlikely to be achieved overnight, and we must be prepared for more political and regulatory obstacles

Crystal Millican, Senior Vice President of Retail and Marketing at Cookies Company

One of the biggest takeaways I learned from 2024 is focus, which is crucial. The industry continues to face many uncertainties and volatility, so whether it’s focusing on product lines for specific markets or new consumer demands, we must continue to lay the foundation for your company’s successful business. For Cookies, we focus on the markets with the greatest growth potential in terms of market share, while continuing to work on product innovation, successful cooperation, and building good partnerships, which can extend to the markets we operate in. By doing so, we can invest more time, energy, and investment in research and development (R&D), which is the backbone of the Cookies company ecosystem

Shai Ramsahai, President of Royal Queen Seeds

This year’s testing scandal and the high cost of regulated cannabis highlight the growing demand for high-quality cannabis genes and seeds in the industry, as more and more consumers around the world seek to grow their own cannabis. This shift indicates a greater emphasis on the source and quality of cannabis, emphasizing that seeds should have elasticity, stability, and consistent production results. As we enter 2025, it is clear that companies that provide reliable genes will lead the industry, making consumers skilled growers and ensuring high standards in the global market

Terry Ascend Executive Chairman Jason Wild

We remain optimistic about the possibility of reclassification by 2025, but given the uncertainty of the timeline, the cannabis industry must ‘make multiple attempts’. If the commercial terms are reviewed by the Supreme Court, we may face a panel of judges who are in favor of our argument. While we wait for the new Trump administration and Congress to take action, this is a more predictable path as the courts have been upholding state rights – the core issue of our case. If we win this lawsuit, marijuana companies will ultimately be treated equally like all other industries

Jane Technologies, CEO and co-founder of Soc Rosenfeld

The mission of cannabis reform will continue until 2025, and I expect the cannabis industry to continue making progress in regulatory reform and ultimately achieve reclassification, bringing new growth opportunities and levels of legality to the industry, businesses, and cannabis itself. This will be another year of sustained dedication and effort, as brands and retailers that prioritize deep data-driven consumer experience will stand out in an increasingly competitive market. In addition to growth, I believe we will also see the industry more committed to addressing the lingering impact of the drug war and paving the way for a more just and open market

Morgan Paxhia, co-founder of Poseidon Investment Management

With the inauguration of President elect Donald Trump and the “red wave” sweeping through Congress, the marijuana industry will usher in the most dynamic regulatory environment to date. The actions of this government indicate a stark contrast to previous policies, opening the door to unprecedented choices for legal marijuana.

Robert F. Kennedy is expected to serve as the Secretary of Health and Human Services, which is a good sign for the February marijuana reclassification hearing and could be officially implemented in 2026. In addition, President Trump may instruct Attorney General Pam Bundy to draft a “Bundy Memorandum” to safeguard the autonomy of states in formulating marijuana regulatory policies. As the reclassification process unfolds, this memorandum may also help eliminate barriers for cannabis companies to access banking and investment opportunities.

The Securities and Exchange Commission (SEC) may appoint a more business friendly person to replace current chairman Gary Gensler, which would benefit small issuers as it could lower regulatory costs and complement the objectives of the Bondi Memorandum. This shift may trigger an influx of capital liquidity into the cannabis industry, easing the funding shortage that has suppressed industry growth in recent years.

As large operators seek strategic mergers and acquisitions, as well as the growth of organic market share to offset pricing pressures, industry consolidation will further intensify. Through indirect acquisitions, leading companies can deepen vertical integration of their core markets, improve operational efficiency, and dominate in an increasingly competitive market. In this market environment, survival is success.

At the beginning of 2025, significant progress may be made in regulating the cannabis industry. Integrating intoxicating cannabis into legal cannabis channels may involve distributing cannabis drinks through alcohol networks, which will address key issues such as inadequate testing, harm to minors, and inconsistent taxation. This shift is expected to increase legal marijuana revenue by $10 billion (a 30% increase from current levels). At the same time, it can improve consumer safety and market stability.

Deborah Saneman, CEO of W ü rk

The number of recruits in 2024 has decreased by 21.9% compared to the previous year, and the industry is shifting from rapid expansion to prioritizing operational efficiency and sustainable growth. With the advancement of legalization efforts (such as the failure of Florida’s Third Amendment and disappointing advertising opportunities in Ohio’s market), the demand for strategic decision-making has never been stronger. This provides an excellent opportunity for our W ü rkforce data analysis tools and other products to play a critical role, helping operators reduce costs and accurately navigate the competitive landscape

Wendy Bronfelin, Co founder and Chief Brand Officer of Curio Wellness

“Driven by increasing consumer acceptance and access (70% of Americans support legalization, and 79% of Americans live in areas with licensed cannabis pharmacies), although it is estimated that the size of the U.S. legal cannabis market will reach more than 50 billion dollars by the end of this century, the industry still faces major obstacles.

The regulatory framework is decentralized, and each state has its own set of laws and standards, which will continue to bring challenges in logistics and operations. Once we have the right regulatory framework, we can avoid the pressures of current market fragmentation, price compression, and integration, and create a new environment where innovation thrives, businesses expand responsibly, and the entire industry grows in a way that benefits consumers, businesses, and communities. In short, an intelligent federal regulatory framework is the key to unleashing the full potential of the cannabis market while ensuring consumer safety and industry sustainability

Hometown Hero Sales Vice President Ryan Oquin

Firstly, the market has shown that consumers prefer cannabis derived products. Most importantly, consumers have more and more products to choose from, which shows that there is still room to accommodate more diverse products. Nevertheless, if the current trend continues to lean towards more restrictions and bans, 2025 may be the most difficult year for the entire cannabis market (cannabis and cannabis). I expect to see more cannabis and cannabis companies offering beverages of different capacities and concentrations. The cannabis industry may also face ongoing challenges from the cannabis industry, as well as resistance from states considering increasing medical or recreational cannabis programs. Products will continue to innovate and improve to meet the differentiated needs of the market

Missy Bradley, co-founder and Chief Risk Officer of Ripple

Our biggest concern is the increasing number of bad actors and fraudulent activities, especially those related to cannabis derivatives, by 2025. While we are satisfied with the future prospects of state regulated businesses, we still have reason to worry if the federal government attempts to lift regulation of the cannabis industry. Once bad actors are convinced that people will no longer pay attention to the cannabis industry, or even not at all, they will open the door to making money. If no enforcement measures are introduced, this industry may fall into trouble. In 2025, I hope to see cannabis companies operate like any legal company in other industries, not just as a company engaged in cannabis business

Shauntel Ludwig, CEO of Synergy Innovation.

I don’t expect to achieve federal marijuana legalization by 2025, but I anticipate that we will see an acceleration in the process of marijuana reclassification and maintain stability for several years, while large tobacco companies, large pharmaceutical companies, and other major players will be prepared to seize the market after marijuana legalization. At the same time, marijuana reclassification also brings some tangible benefits: all marijuana companies will receive capital and tax breaks, which will greatly drive the growth of the entire industry.

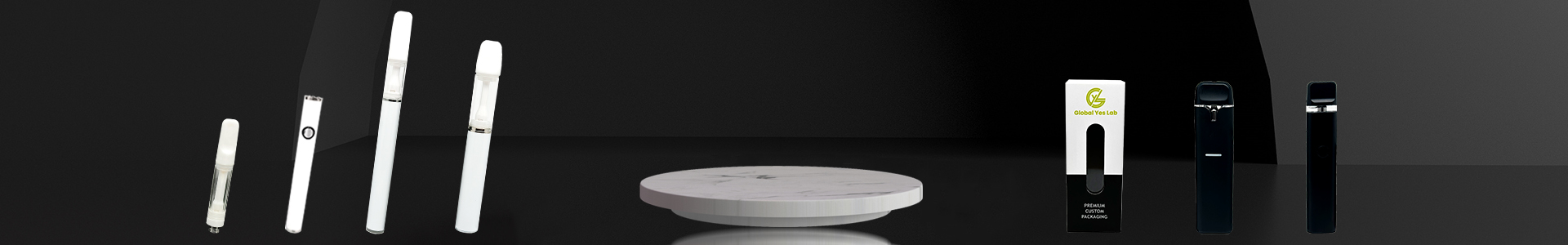

Global Yes Lab will keep pace with the industry and provide customers with high-quality vapes products, excellent services, and the most advanced industry trends.

Post time: Dec-23-2024